The common wisdom is that the stock market goes up when FIIs pump money and it goes down when they take their money out.

While this is true, looking at the FII investment data for the last decade shows that it is not a simple, straight relationship.

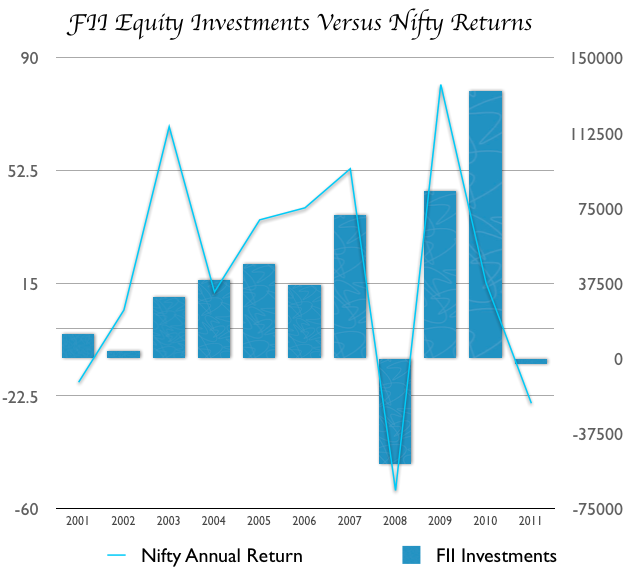

Here is a chart that shows how much money FIIs pumped into equities in each of the last 10 calendar years, and how much Nifty moved in that year. The FII investments are in Rupees Crores, and the Nifty movement is percentage change.

To me, this chart shows the following things about the effects of FII investments on the stock market:

FIIs pulling money from the market has resulted in a fall

There were only two instances in the last decade where FIIs pulled out money from the stock market and at both these times the stock market went down. The pullout was fairly severe in 2008, and the market fall was very bad as well. You may argue that just two years aren’t enough to form a conclusion but I’d say that it is fairly safe to say that if FIIs were to pull out money then the stock market will go down.

Net positive investments by FIIs don’t guarantee an upmarket

The market fell in 2001 and FIIs were actually net buyers in that year so that also shows that the market can fall even if FIIs pump in money, so just positive net investments from FIIs don’t guarantee an up market.

Biggest up moves don’t coincide with biggest FII inflows

One thing that struck me about this chart is that the biggest bars don’t coincide with sharp up-movements in the line. The biggest percentage gains in the Nifty weren’t always in the same year when FII investments were at a peak.

If you look at 2003 – the market went up quite a bit, and there were healthy inflows as well, but if you look at 2004, there were bigger inflows but the market didn’t rise up as much that year.

Similarly, 2009 and 2010 follow the same pattern. I think this can be explained with the high base effect since the market rose so much in 2003 and 2009 that there wasn’t as much room to grow in 2004 and 2010, but all the same this wasn’t something that I understood intuitively before making this chart.

You hear and read a lot about FII'S dominating the stock market movement, and that led me to believe that each big bar will coincide with a sharp rise in the line as well, which is not the case.

Some thoughts on FII Investments

Normally you hear a lot about FII investments when markets fall and people cry hoarse about Indian markets being slaves to FIIs but when the market is going up, no one complains about FIIs pumping money!

I feel that you need to look beyond these moves and think about FII and FDI investments much more holistically.

No comments:

Post a Comment